Wednesday, March 31, 2010

Thankful for Gift Cards

I am thankful today that I won a $25 Target Gift Card from our office. I also won one last week. So that's $50 all together! Not bad for doing a day's work! My office mates have commented that I am lucky in raffles.

Sunday, March 14, 2010

What is the Difference

Happiness and Optimism

Happiness and Optimism Some people believe money leads to happiness. Not true. Once you're living comfortably, more money doesn't buy more happiness. The reverse, however, is true: Happiness leads to money. And success. Likewise, so does optimism. Both enable you to solve problems, conjure ideas, take long-range consequences into consideration and come back and try again if you miss the first time.

Resilience

People who have moved from a bad financial situation into comfort or wealth have resilience. They can overcome—on the job, in their personal lives, with their finances. They don't deny the bad things that happen, but they're able to turn their focus to things over which they have control with the belief that they have the ability to effect change. The good news is you don't have to be born with resilience—you can learn it by controlling the things you can control and letting go of the others. Gratitude

GratitudeThe Karma Kickback. The people who get rich—and stay rich—are not just grateful. They practice gratitude by giving back to their communities, to organizations they believe in and the people they care about. Even if you are thinking of something you view as mundane—like your job—when you think about it as a gift, you focus on what life might be if you didn't have it.

Passion

It is a key element that moves people from a life of financial struggle to one of financial success. The wealthy, simply put, want it more than the rest of that. Some want it in the form of money, but most are quite passionate about the careers they choose to pursue. And, at a time where doing what you love may seem not so possible, it's important to know you can learn to love what you do.

Habitual saving

The wealthy people in our study certainly have the funds to be crazy spenders, but most are not. Both wealthy and financially comfortable individuals say that saving more money has been an "absolutely essential" financial goal as an adult. If you're not a habitual saver already, The Difference will show you how.

Invest in stocks

Jean did the research for this book when housing prices were cratering and the markets were falling out of the sky. Yet, one lesson emerged again and again: The wealthy understand the need to take risks in the market—in good times and in bad—in order to make their money work as hard as they do. Excerpts from this article and pictures courtesy from this website

Saturday, March 13, 2010

Grocery Day

Went to the grocery after work 3 days ago to buy the stuff we needed for dinner. Husband wanted to cook burgers, so we needed some burger buns, cheese, lettuce, etc. When I got there, guess who I bumped into? Husband! He was buying exactly the same things I was supposed to buy. I thought we talked about it and said I would buy it. What are the chances that we would be at the grocery at the same time, and in the same isle?!? The universe is helping us save!!!!

Anyway, to cut a long story short, good thing I bumped into him because I had coupons! With all the stuff we bought and some FREE stuff from the coupons (pasta sauce, shell macaroni), guess what our total bill was?

Total Bill after club card savings and coupons = $13.46!!!!

Wooohoooo! We saved $12.79!!!! That's almost 50% off (original bill was $26.25!). I love coupons!

Anyway, to cut a long story short, good thing I bumped into him because I had coupons! With all the stuff we bought and some FREE stuff from the coupons (pasta sauce, shell macaroni), guess what our total bill was?

Total Bill after club card savings and coupons = $13.46!!!!

Wooohoooo! We saved $12.79!!!! That's almost 50% off (original bill was $26.25!). I love coupons!

Sunday, March 7, 2010

New Career

Spouse is looking at going into a new career now. He was laid off last November, and at his age, is seriously thinking about starting a new career. He wants to become a real estate broker. I know this may sound stupid to some people given that the real estate market is so bad right now. But I'm trying to keep a positive attitude because I want him to do something which he will love doing, and not have to have too much stress as he did in his former job. I think he will be good, because he is good with people.

Tuesday, March 2, 2010

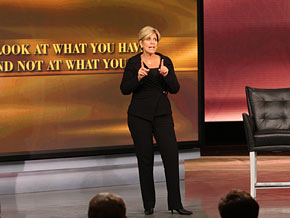

Look at What You Have

This article is courtesy of an Article in Suze Orman's website. Step 5 really made an impression on me and can really help me in trying to get through this tough financial patch. Things will get better!

Which is why Suze says it's so important to look at what you have and be grateful, instead of looking at what you've lost and feel angry. "If you continuously look in the rearview mirror while you're going forward, you're going to get in an accident. And the victim of that accident is going to be you," she says. "Don't compare. You'll feel stronger, you'll have more energy and you'll be able to turn this around."

Be grateful for the savings account you do have or the family that has helped you through. Although she knows it isn't easy, Suze urges everyone to see what they've been through as a kind of blessing. "When you are grateful—when you can see what you have—you unlock blessings to flow in your life."

Step 5: Look at What You Have, Not What You Had

How much longer should we expect times to be tough? "Things will get better, get worse. ... [In] the next two or three years, it will start to turn around," Suze says. "But I'm so sorry to say it will be, in my opinion, 2015 until every single person feels hopeful again."Which is why Suze says it's so important to look at what you have and be grateful, instead of looking at what you've lost and feel angry. "If you continuously look in the rearview mirror while you're going forward, you're going to get in an accident. And the victim of that accident is going to be you," she says. "Don't compare. You'll feel stronger, you'll have more energy and you'll be able to turn this around."

Be grateful for the savings account you do have or the family that has helped you through. Although she knows it isn't easy, Suze urges everyone to see what they've been through as a kind of blessing. "When you are grateful—when you can see what you have—you unlock blessings to flow in your life."

Subscribe to:

Posts (Atom)